Over the last few weeks, nearly every conversation I’ve had with customers has circled around the same thing: tariffs.

With major changes going into effect on May 2, and more coming right after, logistics and procurement teams are being forced into emergency planning mode — again. I’ve spent a lot of time lately with shippers who aren’t just trying to move containers. They’re trying to protect cash flow, rework sourcing models, and figure out how to adapt before the next round of rules hits.

We recently recorded a fireside chat about all this — and while we didn’t land on perfect answers, what we did do is walk through the real challenges we’re seeing across our customer base. So I wanted to put some of those insights into writing and share what I’m hearing on the ground.

The End of De Minimis: Small Shipments, Big Problems

The de minimis rule — which let shipments under $800 into the U.S. without duties — has been a cornerstone of DTC and small-parcel import models. As of May 2, it’s going away. Not just for China, but for all countries.

For a lot of smaller importers, that’s a huge deal. These are companies that ship lean and don’t have the volume to consolidate containers easily. Losing duty-free status means many will need to rethink their model entirely. Some are already halting shipments. Others are scrambling to push as much volume as they can before the deadline.

If your logistics operation depends on shipping goods under that threshold, this is your moment to get proactive. Consolidation strategies, FTZ use, alternative sourcing — all of it needs to be on the table right now.

The Auto Industry Is Bracing for May 3

Automotive importers are facing their own version of whiplash. A sweeping flat tariff was originally proposed for imported vehicles. That’s since evolved into a new content rule that appears to offer some relief — but for tier 1 suppliers and OEMs that do multiple border crossings between the U.S., Mexico, and Canada, there’s still a lot of uncertainty.

We’ve got automotive customers who move parts across the U.S.-Mexico border five, six times before final assembly. Even small changes in how tariffs are applied to those movements could make their entire model unsustainable. What I’m hearing now is cautious optimism, but also a lot of contingency planning. Nobody wants to get caught off guard twice.

Customers Are Pouring into FTZs and Bonded Warehouses

Over the past month, I’ve seen a sharp increase in customers pushing goods into foreign trade zones and bonded warehouses. And it makes sense — when you don’t know what your duty exposure is going to be in 30, 60, or 90 days, the best move is to delay payment as long as possible.

I spoke with a customer who’s using a U.S. distribution hub to service both North and South America. They’ve expanded their FTZ footprint aggressively so they can avoid paying tariffs on goods that aren’t even headed for the U.S. market.

This is especially critical for anyone in seasonal retail — apparel, holiday goods, anything with a tight cash flow window. Deferring duties until a sale is made can make or break your margin this year.

We’re Seeing Rolled Containers and Routing Chaos

One thing we didn’t spend enough time on early in this tariff conversation is the impact on routing and vessel planning. As sourcing shifts away from China and toward Southeast Asia, we’re seeing increased port congestion, unreliable sailing schedules, and more rolled shipments than usual.

The infrastructure just isn’t there yet in places like Indonesia and Vietnam to fully absorb the volume. And now there are new proposals targeting ships built in China or operated by Chinese carriers, which could further complicate port operations in the U.S.

All of this affects our customers in real time. One day your container is scheduled to land at Long Beach on Thursday. The next, it’s been rolled or redirected due to terminal congestion. And when that happens, you don’t just lose time — you lose control.

That’s where visibility becomes critical. When you know exactly what’s happening with every container, you can act faster, notify downstream partners, and keep your customers informed.

So What Can You Actually Do Right Now?

If you’re an importer or freight forwarder trying to make sense of this moment, here’s what I’m recommending to customers right now:

- Track tariff changes daily — not just the big ones, but the ones that apply to your specific commodity code or country of origin.

- Re-evaluate your shipment strategy — look for consolidation opportunities or alternate routes through less-impacted ports.

- Use FTZs and bonded warehouses where it makes sense — this is a practical way to buy yourself time.

- Invest in visibility — the faster you know where your containers are and what’s happening to them, the better decisions you can make.

We're in This Together

One of the themes that came up again and again in our fireside chat was this: nobody has perfect answers right now. Policy is changing fast. What’s true today might not hold next quarter. But what we can do is stay informed, stay flexible, and keep communicating.

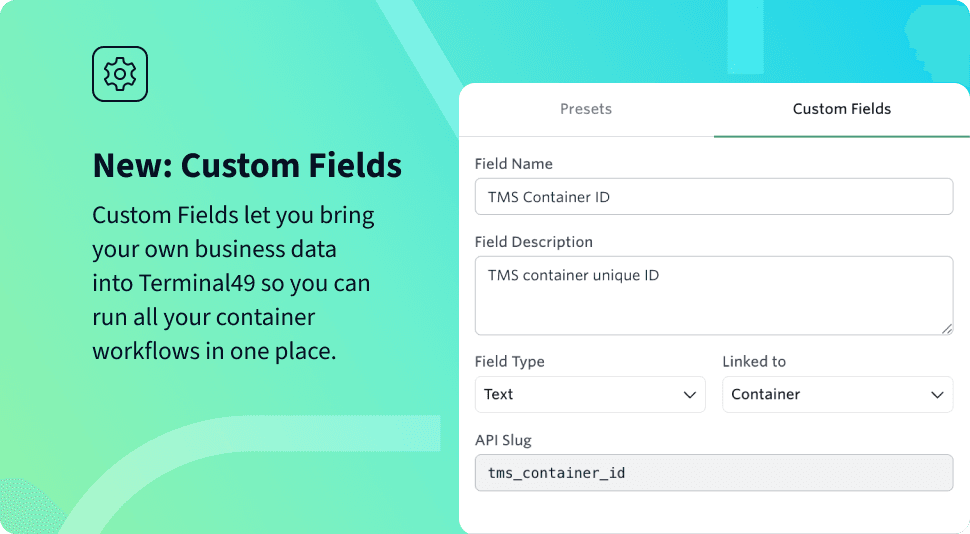

At Terminal49, our job is to make the container tracking side of all this easier. We eliminate manual check-ins. We show you exactly which containers are at risk. And we help our customers get ahead of surprises before they turn into delays or penalties.

We’re all in the same boat right now. And we’re here to help you steer through it.

– Dom

Want to see how Terminal49 helps customers handle container visibility in real time? Request a demo or watch the full fireside chat on YouTube