In the import business, timing has always been everything. But with President Trump’s sudden “Liberation Day” tariff announcements, real-time container tracking has become the difference between profit and loss.

The speed at which these new tariffs are being implemented is unprecedented.

Here is what you need to know about the "Liberation Day" Tariffs:

- The baseline 10% tariff takes effect tomorrow, April 5, 2025

- Targeted reciprocal tariffs hitting just four days later on April 9 layer higher tariffs (up to ~50%) on shipments from countries deemed to have unfair trading practices.

- There are a number of exemptions, shippers will need to know about.

- The end of End of De Minimis for China/Hong Kong, which means no more “duty-free” cheap parcels from China – every parcel’s landed cost just went up. Companies shipping via couriers must file entries and pay duties on a much larger volume of shipments, adding paperwork and cost.

Tariff Exemptions include:

- U.S. Customs and Border Protection (CBP) confirmed that goods already loaded and in transit before the cutoff are exempt from the additional duty, even if they arrive after April 5 or 9th, respectively.

- Humanitarian essentials like food and medicine are exempt.

- Products already subject to existing U.S. trade measures are carved out to prevent double taxation. For instance, steel and aluminum imports and automobiles and auto parts, which have their own 25% tariffs, are excluded from the new 10%/50% tariffs.

- Goods qualifying under the USMCA free trade agreement remain duty-free despite the new tariffs.

In practice, this means if your container ship left the origin port before the deadline, you won’t pay the new tariff on that cargo. Importers are now racing against the clock to determine which shipments fall under the old duty rates — and which will face steep new costs.

Timing matters immensely.

Depending on cargo value, a container arriving just hours before or after a tariff deadline could mean a difference of thousands — even millions — of dollars. That’s why knowing exactly when your container departed its origin port or arrived at a U.S. terminal isn’t just helpful anymore. It’s mission-critical.

We've Seen This Before — But This Time Is Different

If this feels familiar, it’s because we’ve been here before. The administration’s tariff approach so far has involved sudden announcements, quick implementations, and even last-minute reversals. But this round of tariffs is moving faster, hitting broader categories, and is more likely to trigger immediate reciprocal actions from key trading partners.

In fact, China has already issued its own retaliatory measures, and other nations are expected to follow. This creates a constantly shifting, high-stakes landscape for importers, customs brokers, and logistics teams alike.

And when everything’s changing by the hour, guesswork becomes dangerous.

🔗 Related Reading: Assessing the Impact of the ILA Strike on Operators and Other Stakeholders

Labor actions and policy shifts like this one are part of a growing pattern of disruptions importers need to be ready for.

Impact on Importers: Higher Landed Costs, Compliance Hurdles, and Urgent Planning

Landed Cost Impact

For importers, these tariff changes hit the bottom line immediately.

The most obvious effect is higher landed costs. A 10% or 25% duty hike can mean tens or hundreds of thousands of dollars in extra import taxes, which either squeeze profit margins or get passed to consumers.

Importers of consumer goods like electronics, apparel, furniture, and appliances now face significantly higher duty bills. For example, a $100,000 shipment of appliances from Mexico that doesn’t meet USMCA rules would incur an extra $25,000 in duties overnight. Even an onslaught of “low-value” e-commerce orders from China – which used to fly under the tariff radar – now collectively rack up substantial duty charges that didn’t exist before.

Compliance and Operational Impact

Beyond direct costs, importers are encountering a wave of compliance and operational challenges. Tariff increases often come with new regulatory requirements. Invoices for products with metal components must be reformatted to separate the value of steel/aluminum content versus other materials since the 25% duty applies only to the steel/aluminum portion.

These are non-trivial adjustments; failure to comply could mean fines or shipment delays. Importers are working closely with customs brokers and suppliers to update documentation, classification, and bonding to meet the new requirements.

Planning Impact

Another major challenge is the sheer speed and uncertainty of these changes. Normally, tariff adjustments come with some lead time or phase-in. In this case, the White House invoked emergency powers to impose tariffs with just days’ notice. Policies have been changing week-to-week. For example, imports from China and Hong Kong were initially hit with a 10% increase on March 4, only to see that doubled to 20% by March 7. Such whiplash-inducing shifts make it extremely hard for importers to plan shipments.

Without real-time tracking and accurate container data, you risk:

- Miscalculating landed costs

- Filing incorrect customs entries

- Facing penalties for underpayment

- Missing critical windows to expedite or delay shipments based on tariff exposure

For companies operating on thin margins — especially in retail, consumer goods, and electronics — these risks aren’t hypothetical. They’re existential.

React Faster, Reduce Risk, Protect Your Margins with Real-Time Container Visibility

In a tariff-driven environment, visibility isn't just helpful—it’s mission-critical. When duties can change overnight and shipments are racing against the clock, importers need clear, accurate, up-to-the-minute tracking to avoid costly mistakes and stay compliant.

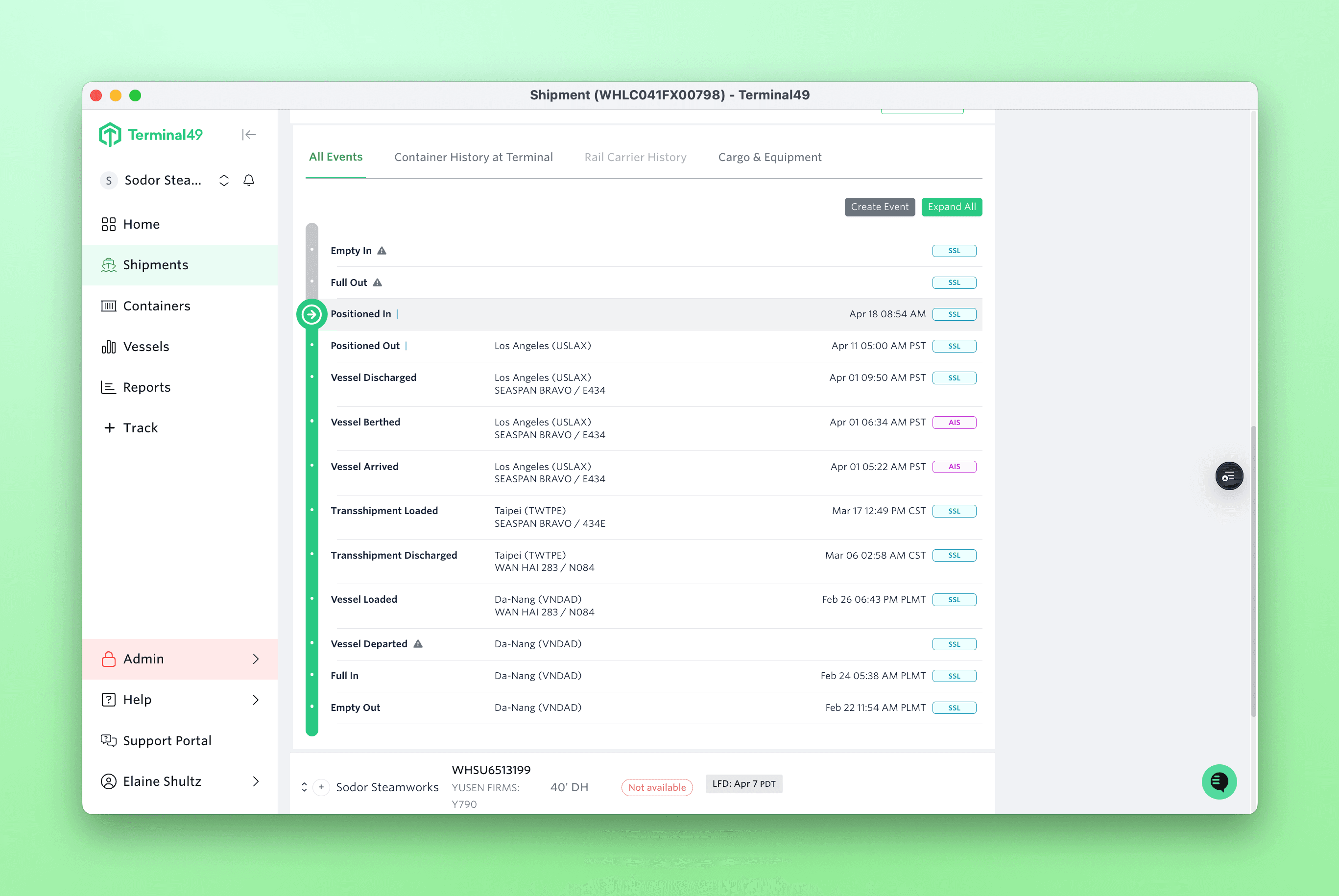

That’s where Terminal49 comes in.

We give importers the tools to react fast, reduce risk, and protect their margins. Our platform automatically tracks containers across all major U.S. terminals and provides the real-time updates your team needs to confidently make decisions.

Here’s what real-time tracking helps you do:

1. Beat Tariff Deadlines

Stay ahead of key policy cutoffs like April 5 and April 9.

- Know if your container will depart in time to qualify for lower duties

- Reroute, expedite, or prioritize customs clearance before deadlines hit

2. Prove “In-Transit” Status

Support duty exemptions with hard data.

- Timestamped milestones (like origin port departure) help brokers file correct entries

- Avoid overpaying because of incomplete or unverifiable shipment details

3. Keep Everyone Aligned

Get your team, customs broker, and 3PL on the same page.

- Shared dashboards serve as a single source of truth

- Custom alerts flag delays, port updates, and at-risk shipments

4. Avoid Demurrage and Detention Fees

Stay ahead of costly delays, especially when volume spikes around tariff dates.

- Know each container’s Last Free Day

- Set alerts to ensure timely pickups and customs actions

5. Plan Smarter, Long-Term

Use historical data to build resilience into your supply chain.

- Identify patterns in carrier reliability and port delays

- Rethink sourcing and routing based on actual landed cost under new tariffs

This isn’t about flashy software or extra dashboards. It’s about giving your operations team the data they need, when they need it. No more chasing spreadsheets or relying on weekly status checks. With Terminal49, you get:

- Real-time ETAs and actuals

- Departure and discharge timestamps

- Customs hold and port status updates

- At-risk container alerts — so you know what needs action now

💡 Want to see how this works in the real world?

Check out how one freight forwarder used Terminal49 to eliminate manual container tracking entirely, and how Valor Victoria reduced detention and demurrage fees to zero using our platform.

What You Can Do Right Now

Here’s how to get in front of this fast-moving situation:

- Audit your inbound shipments — Identify containers arriving between April 5–9.

- Enable real-time tracking with Terminal49 — Know exact port departure and arrival times. (You can sign-up for a free two-week trial here)

- Coordinate with your customs broker — Ensure accurate declarations, Certificates of Origin, and tariff classifications.

- Set up alerts for at-risk containers — Get ahead of any cost-impacting delays.

Final Word: This Won’t Be the Last Disruption

Tariffs may be top of mind today, but tomorrow it could be labor strikes, weather events, or another geopolitical shake-up. The companies that come out ahead will be the ones that invest in real-time, risk-aware logistics infrastructure now — not after the fact.

Terminal49 gives you that edge.

👉 Start your free two-week trial today and get immediate access to real-time container tracking, automated alerts, and full visibility across all U.S. terminals. No credit card required — just clarity and control when it matters most.

👉 Don’t wait for your margins to take a hit. Talk to our team today to future-proof your import operations together.