nternational shipping costs have risen much higher during the pandemic than analysts have predicted – creating unprecedented, all-time highs. According to a recent report by the Federal Reserve Bank of St. Louis, the costs of moving goods by ocean from China to the US West Coast have increased by more than 70% from pre-pandemic levels. As a comparison, ocean transport costs increased 41% in the aftermath of the recession triggered by the 2007-2008 Financial Crisis.

All of the factors that contribute to supply chain woes - stores seeking to replenish inventories; factories limiting capacity due to COVID restrictions & compromised workforces; higher fuel costs for ocean vessels; backups at ports; unsynchronized links between ships, ports & trucks, and continued demand from increased consumer purchases – suggest that shipping costs will remain high in the foreseeable future.

In this high-priced environment, shipping companies are seeking greater economies of scale, in the form of larger cargo ships. In 2020 (according to the Maritime Reporter) the world’s largest container ship was the HMM Algeciras, which has a capacity of 24,000 teu (twenty-foot-equivalent unit). Last year, Ocean Network Express ordered six new container ships with a capacity in excess of 24,000 teu.

While bigger may be better for carriers – it’s not always better for customers:

· Last year, the industry saw the largest spike in lost containers at sea in more than a decade. Claims from lost & damaged cargo are skyrocketing – and insurers believe this is correlated to the increased size of ocean vessels.

· In addition to damage/loss-claims - time delays are increasing exponentially. In March of 2021, one of the largest cargo ships in the world – the Even Given - blocked the Suez Canal, causing delays to hundreds of other vessels waiting to transit the canal. That single incident was estimated to have affected more than 12% of total global trade.

For numerous reasons, the factors that are negatively impacting the supply chain are here to stay (at least for the next several months). The good news is – that there’s more data & analytics available today than ever before – and these tools can help customers identify changes to cargo ship ETAs, enabling them to better synchronize the last miles of their deliveries.

The Terminal49 Ocean Freight Supply Chain Visibility Platform provides:

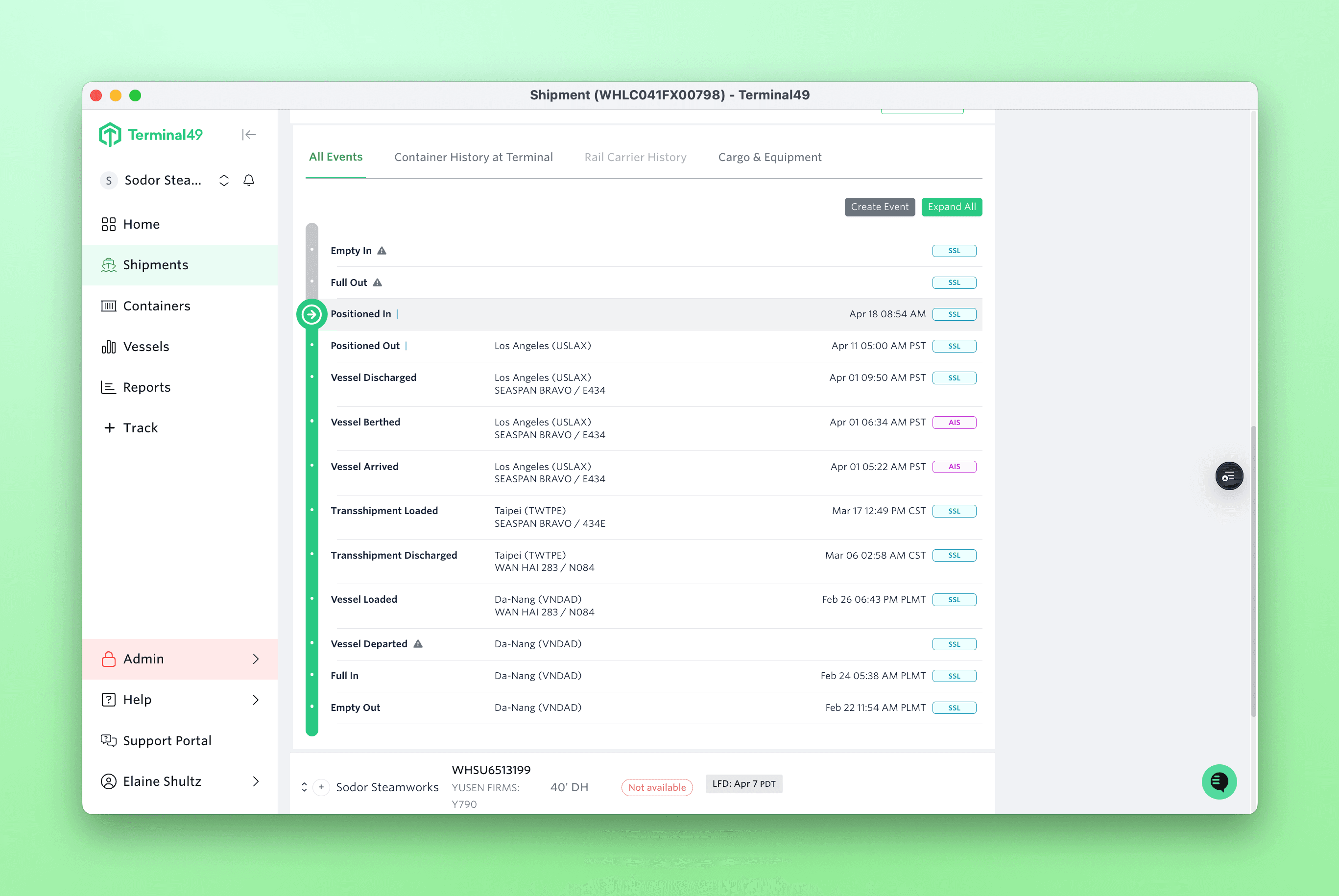

· Automatic, Universal Track & Trace: to automatically track containers across all the major steamship lines and terminals (availability, LFD, holds etc).

· Immediate notifications of any ETA changes. Once you add a BOL, Terminal49 automatically tracks all containers that are part of the BL and sends you an email any time an ETA changes.

· Accurate data from the source. Terminal49 integrates with steamship lines, ports and terminals and ties all the data together so you only have to go to one place for all your container activity.

· All you need is a Bill-of-Lading: Once you enter the BOL, Terminal49 starts tracking the containers, and no additional data entry is required.

The reality of ocean freight today is that it’s more expensive than it’s ever been – and delays on the ocean can bring incremental costs to shippers who are unable to synchronize their supply chains. Information assets like Terminal49’s software platform provide visibility that customers need to avoid excessive demurrage & per diem charges. This visibility helps customers catch issues before the ripple effects take hold, and turn what could be a minor delay into a longer and more expansive delay that requires incremental time and labor to sort out.

To learn more about the “Smartest Way to Track & Trace Containers” visit: https://app.terminal49.com/register.