The world of container shipping is in turmoil, full stop. Reading the news over the last month or so, the talking heads seem to be at odds over what the interruption of shipping lanes in the Red Sea, the Panama Canal, and reallocation of capacity by shipping lines will mean for the shipping industry in 2024. While there is a lack of a hard consensus, there are some operational knock-on effects that we’re already seeing in our data at Terminal49. So, for today's blog post, let’s dive into how Global Container chokepoints are affecting operations at US Terminals.

- West Coast US Ports: Port transit times are up across all of the West Coast ports in December, and will probably be higher in January. The Panama Canal is now at the height of the dry season, and the drought is having a huge effect, forcing traffic to the US West Coast. However, container volumes were also down during December. This lower volume with higher arrivals and increased transit times is a leading indicator of an inefficiency in supply chain design currently.

- Gulf Ports: Transit times are way up, and under the threat of getting far worse. Volume is recovering nicely as containers reroute around the Panama Canal, but expect delays with the Suez crisis and an impending showdown with shore labor that are going to squeeze the capacity for Gulf Ports in the short term.

- US East Coast: US East Coast port operations are a frog in a boiling pot right now, facing a tough triple threat. To start, FBX index shows that container rates that transit the Suez have tripled in the last three weeks, up to around $4500 per box. There is a capacity and routing rebalancing going on to account for the extra time and cost to go around Africa, and that’s adding another 6-8 days to the journey. Finally, volumes on the East Coast are up in December, but so are transit times. Hopefully, rates slow the inbound to the East Coast, or there will be a huge crunch on the horizon.

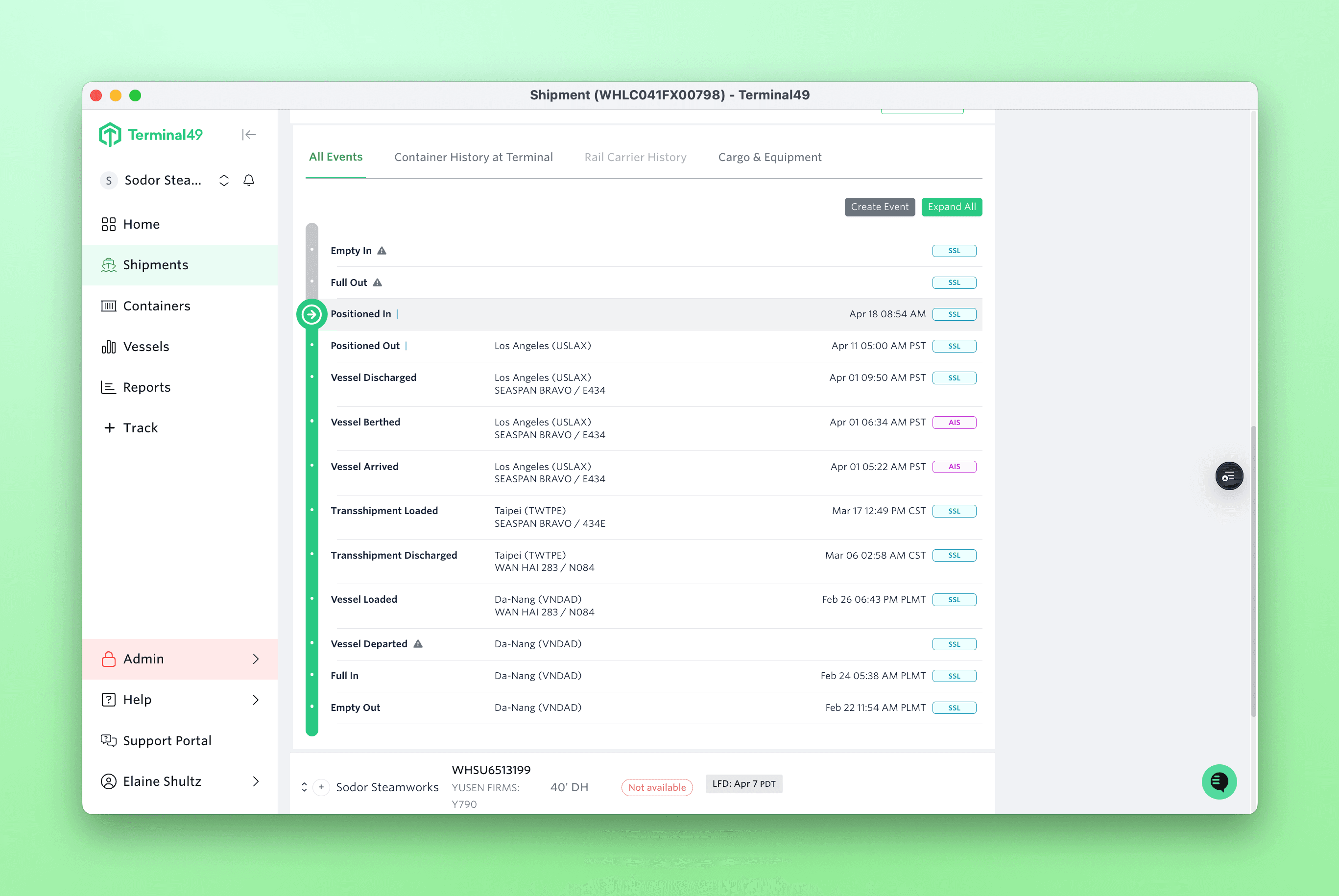

So if you’re a freight forwarder or shipper, and you’re looking at this article for actionable insights, there’s good news and bad news. The good news: everything currently wrong can be accounted for with better visibility and good historical data. If you upgraded your track and trace capabilities during COVID, you’re probably still fine. If you haven’t, take this as a sign to invest in automating your capabilities while times are good.

The bad news: the might of the US military against irregular forces in the Middle East supported by foreign actors is never a short story, and there’s not a quick fix for the Panama Canal trying to become the Panama trench. So while it’s unlikely everything crumbles like it’s 2021 again, you should be prepared to do some exception management to keep things running smoothly.