Implementing The OSRA 2022 Final Rule on Detention and Demurrage

The OSRA 2022 final rule went into effect on May 28. Considering the nuances and depth of the newly commenced regulations, many questions persist on how stakeholders can navigate and leverage the details of the ruling, especially with respect to active parties like the BCOs, importers, NVOCC, ocean freight forwarders, and drayage providers. This article seeks to help answer these questions, including what to expect.

What is the OSRA 2022 Final Rule?

The rule as a draft has been in the making for the last couple of years, and the final rule only came out a couple of months ago, on the 26th of February, 2024.

It deals with the invoicing requirements and the specificity around inverse invoicing pertaining to demurrage and detention invoices. This means asking questions like:

- Who are the parties that are being invoiced?

- What is the timing and the billing process for the invoice?

- What should be in the invoice?

- How should you pay the invoice?

- How does it affect different parties?

- What are the changes from before?

In many ways, the ruling is not new. There have always been guidelines around invoicing. But there are now federal rules around being very specific about the requirements related to the diversion detention invoice.

Why Was OSRA Needed?

It was a free-for-all for a while in the industry, going back to 2018.

BCOs felt they were being taken advantage of by carriers, who treated demurrage and detention as revenue sources. This led to an original uprising many years back, which led to the first rule going into effect in June 2022. However, this final rule clarifies some definitions missing from the original ruling, especially requirements and timing.

The ruling was needed to address the following:

1. No Standard Process Around Who Should Be Billed

Before this ruling, no standard process existed regarding who should be billed. Carriers were getting invoices for per diem, LSPs were getting invoices and were fronted the bill by the carriers, which created distrust and friction between the parties.

2. No Standardized Billing Process

Before the OSRA, there was no standard billing process, such as when an invoice should be processed. People were getting invoices months and sometimes years after charges accrued. There existed no clear dispute-clearing process.

3. To Reduce Unjust Billing Practices Heightened by Significant Fees Charges and Collected by Carriers

Cargo owners felt unjust billing practices were heightened by significant fees charged and collected by ocean carriers. At the end of the day, they were making those charges, but it created friction and mistrust between their direct vendors, who were often cargo owners and drayage providers.

4. Lack of Data and Visibility To Support Disputes

Validating charges before the OSRA was challenging because of the lack of data and visibility, leading to a lengthy dispute process. With the OSRA ruling, there are very specific criteria around the dispute and billing process.

How Does The OSRA Ruling Affect Stakeholders?

Stakeholders include cargo owners, logistics service providers, freight forwarders, customs brokers, drayage carriers, NVOCCS, and marine traffic operators.

The material difference is on the invoice and the party it is billed to, which is the BCOs. The new OSRA ruling also has an established process -- the 30-30-30-day rule. Carriers cannot hold a trucker and trucking carrier responsible or insist on the carrier having financial obligations. However, because it's a free market, the BCOs can ask the carriers and other logistics providers to bear some of the financial burden as part of the negotiating process.

Other stakeholders, especially the logistics providers, now have clear billing responsibilities, reduced disputes and administrative overhead, faster and more accurate billing cycles, and efficient management of financial liabilities and disputes.

MTOs must also maintain the same invoicing standards as the carriers to ensure a transparent and accurate billing process.

The Billing Timeline (The 30-30-30 Day Rule)

The 30-30-30-day is a billing timeline that is part of the OSRA ruling. The new billing timeline will feature the following:

1. Issuing Invoices

Invoices are to be issued by the billing parties (carriers and MTOs, inclusive) within 30 days after the detention and demurrage charges stop accruing.

2. Disputing Charges

Billed parties (such as shippers and consignees) have 30 days from when the invoice was issued to make a dispute if there is a need for one.

3. Resolving Disputes

Once a dispute has been raised, the billing party has to resolve such dispute within 30 days. However, the last 30 days can be extended if both parties agree.

Tips for Compliance and Disputes (Action Plan)

One thing the new OSRA ruling has tried to enforce is the application of speed in billing and disputes. More importantly, it is eager to eliminate unfair practices, such as sending invoices to cargo owners and drayage carriers two years later.

The following tips will help all stakeholders stay compliant.

1. Timeline

Always respond within 30 days. Whether the cargo owner receives the bill or the carrier receives a dispute notice.

2. Submission

Try to resolve the dispute with the carriers and LSPs before taking it up with the FMC. However, if that is unavoidable, include specifics, such as: is the charge justified? Is the bill compliant? What are the contract terms and fees? Attach proof.

3. Clarity

Always ensure simplicity and lack of ambiguity in the compliance and complaint filing.

4. Documentation

Always have five years of documentation accessible and ready when filing a complaint. It is also important to document SOPs with freight forwarders and drayage providers, including contract terms, payment, and audit and dispute processes.

5. Invoicing

Ensure the invoice from the biller includes the following information at a minimum: date of container availability, port of discharge, container number, earliest return date, allocated free days, start and end dates of the free days, applicable rule and daily rate, the total amount due, contact information, compliance statement, and carriers performance statement.

The Role of Visibility Providers

With the OSRA 2022 final ruling seeking more transparency and fairness in how shipping stakeholders manage their logistics operations, it is clear that visibility would be a core factor in ensuring it is successful.

This is why visibility providers are so critical to the implementation of the new rule. They will help shippers audit invoices effectively by tracking milestones, such as availability, last free day, demurrage, detention, and available appointments. Among others.

Terminal49 Solution

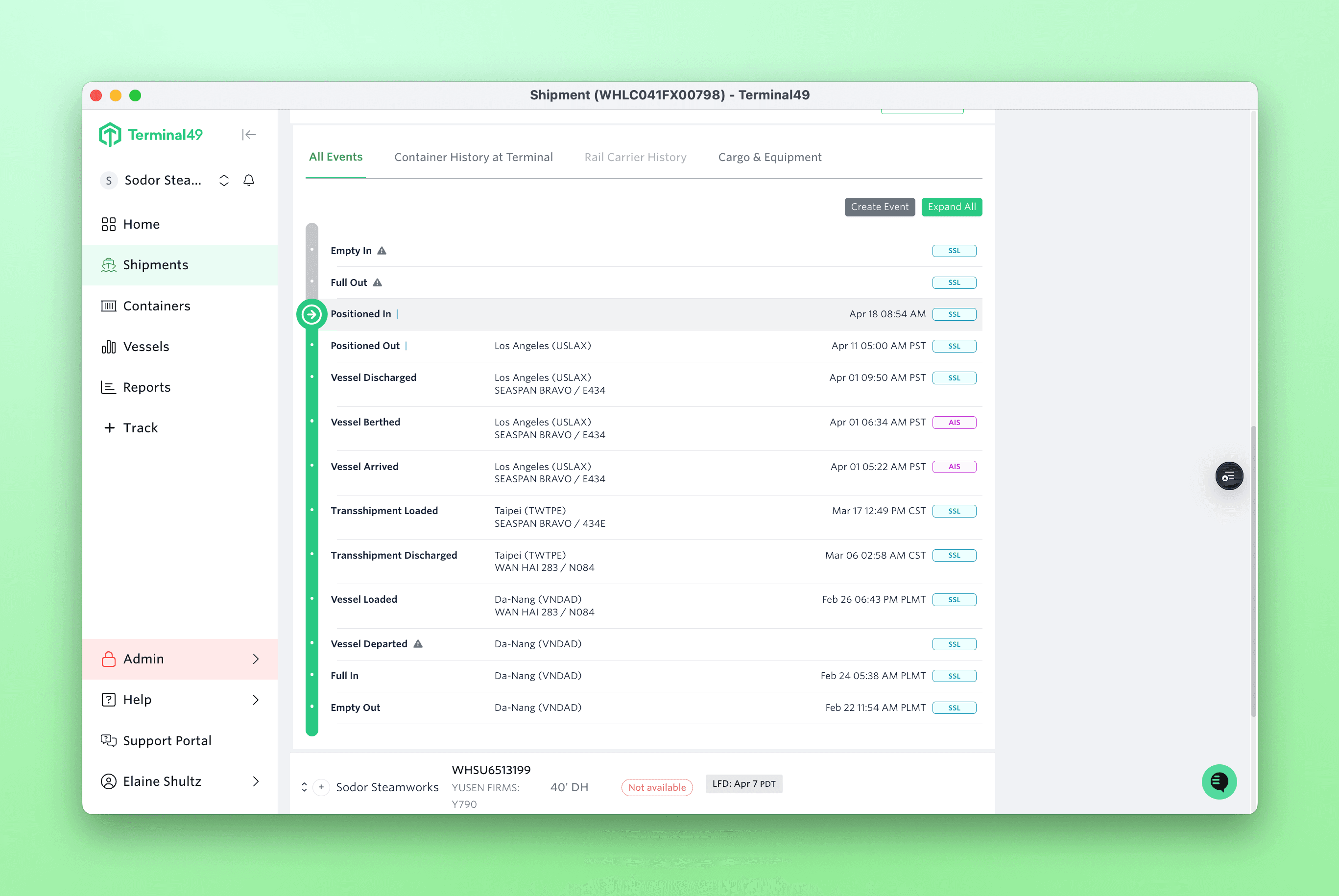

Terminal49 has been in the business for over five years; we help the greater supply chain industry, BCOs, and logistics service providers automatically track containers and manage containers at risk.

We do this by pulling data from various sources, tracking containers globally across all major ocean carriers or 98% of the cargo movements globally. Terminal49 is connected to every single terminal and rail in the United States, Canada, and Mexico, providing critical inbound and outbound visibility on what's happening at the terminals to your final destination or arrival. This helps eliminate manual container tracking. Everybody in your organization and supply chain knows what is happening with their shipping containers and what to do next.

More importantly, you can effectively plan and mitigate exceptions, demurrage, and per diem.

Effectively communicate this data within your organization and work with your partners on Terminal49.

Frequently Asked Questions

Q1: Are there tools that can calculate free time easily for BCOs?

A visibility tool like Terminal49 constantly monitors the status of a container and builds an audit trail of the status changes, availability, and last-free-day (LFD) changes. This provides the user with data to match against that of the carrier.

Q2: If any party goes past the 30-day timeline, what are the consequences for BCO?

It depends on the party. If it is the BCO, then the BCO is obligated to pay it, but if it is the carrier or LSP, they are obligated to pay it.

Q3: How do you show you have an agreement to extend?

It starts with documenting the contract terms with carriers and LSPs. This way, there is provenance transparency, and it is easy to make a case during the dispute process.